Mastering Amazon Sellers Bookkeeping: A Complete Guide to Managing Your Finances Effectively

- Team Book Tech

- Jul 3, 2025

- 3 min read

Updated: Nov 20, 2025

Bookkeeping for Amazon sellers goes beyond a simple task; it is foundational to running a successful e-commerce business. The online marketplace is highly competitive, and sellers must effectively manage their finances to succeed. Accurate bookkeeping ensures tax compliance, promotes profit clarity, and highlights strategic growth opportunities. This guide covers essential components of Amazon bookkeeping, popular software options, common challenges, and practical solutions.

The Importance of Accurate Financial Records

For both new and seasoned sellers, maintaining precise financial records is crucial for understanding the overall health of the business. Effective bookkeeping simplifies income reporting, prepares you for tax season, and helps evaluate performance over time.

Utilizing suitable systems means you’ll always have up-to-date figures on sales, expenses, and taxes. For instance, a study found that 40% of small businesses fail to accurately track their income and expenses, which can lead to missed growth opportunities and financial discrepancies. Additionally, having clear documentation can significantly avert costly errors during audits or reviews.

Being proactive in your accounting practices not only prevents pitfalls but also lays the groundwork for informed financial decision-making.

" If your business operates across multiple sales channels, you may also benefit from our complete guide for e-commerce owners "

Key Components of Amazon Sellers Bookkeeping

Tracking Sales Transactions

One of the first steps in managing Amazon finances is meticulously tracking sales transactions. Each sale must be documented, including pricing, sales tax collected, and any returns processed.

Using bookkeeping software can streamline this process. For example, systems like A2X can automatically pull transaction data directly from your Amazon store into financial reports. This minimizes the need for manual entry and helps maintain accurate records effortlessly.

Monitoring Inventory Costs

“ If you also manage a Shopify store alongside Amazon, check out our complete guide for Shopify store owners ”

Managing Amazon’s Fees and Commissions

Popular Bookkeeping Software Options

Selecting the right bookkeeping software is vital for optimizing Amazon sellers' operations. Here are some popular options tailored specifically for e-commerce businesses:

QuickBooks Online stands out for its robust functionality and ease of use. It integrates smoothly with Amazon, assisting with invoicing, expense tracking, and generating comprehensive financial reports.

Xero offers user-friendly features and strong inventory management tools, making it an excellent choice for Amazon sellers. Its automation functionalities can save significant time and minimize errors.

Designed specifically for Amazon sellers, A2X extracts your sales data from Amazon and organizes it within your accounting system automatically. This software reduces manual data entry and simplifies sales data reconciliation.

Wave is a complimentary accounting tool that suits small businesses perfectly. Although it may lack some advanced features, it provides outstanding basic functions such as tracking income and expenses.

Common Bookkeeping Challenges

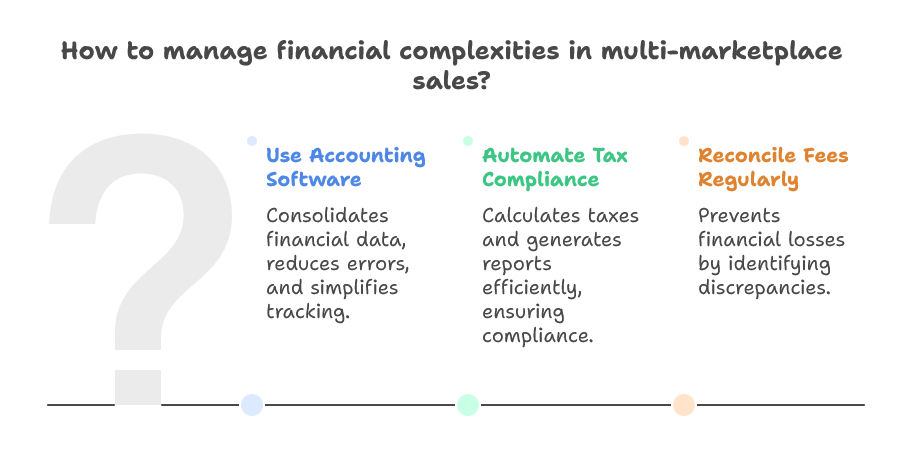

Sellers often encounter challenges in managing their books, even with available tools. Here are some typical hurdles and potential solutions:

Outsourced Bookkeeping Services

For many Amazon sellers, managing bookkeeping can become overwhelming and divert attention from scaling their businesses. Outsourced accounting can be a practical solution.

Hiring professionals who specialize in Amazon bookkeeping provides the expertise needed for accurate financial reporting. This allows sellers to concentrate on core business activities.

Book Tech, specializes in Amazon bookkeeping solutions tailored to the needs of e-commerce entrepreneurs. By leveraging expert support, sellers can streamline operations and achieve long-term success.

" For businesses managing retail inventory or POS systems, here’s our complete guide for retail store bookkeeping "

Navigating Your Path to Financial Success

Mastering Amazon bookkeeping is crucial for all sellers striving for success in the competitive e-commerce landscape. By concentrating on accurate financial records, diligently tracking sales and expenses, and utilizing the right software, you can ensure tax compliance while gaining insight into your profits.

Addressing common challenges like multi-marketplace management and sales tax complexities can be achieved through effective strategies or outsourced services. Recognizing the value of precise financial tracking offers savvy entrepreneurs a clear advantage as they navigate their Amazon journey.

Remember, your financial records are more than just numbers; they are a roadmap to your business’s success. Embrace the tools and practices available to unlock growth and maintain a profitable Amazon store.